| August 2007 |

Entrepreneurs Drive Growth With Big Investors Targeting Treatment, Small Entrepreneurs Are Still the Engines of Expansion A few years ago, Mark Houston began to get the idea that he wanted to do something different after having worked for years as a top industry executive in the Texas addiction treatment market. And, besides, Houston had always had a bit of the entrepreneurial bug. “I wasn’t getting any younger,” he says, adding that conditions seemed right, the treatment market having more than fully recovered from the deep managed care induced recession of the 1990s. So, he approached a financial backer and the two worked out a deal where the investor would provide financing in return for a 50 percent silent partnership in Houston”s proposed venture. Mark Houston Recovery Centers opened its doors on a sprawling $1.4 million ranch outside of Austin, TX, in July of last year. The center had a rather unique model in an industry where claims of uniqueness proliferate, but often wind up falling short. Going after the large segment of the market comprised of people who have relapsed and don’t need, or want, primary care again, Houston decided to launch a long-term nonclinical recovery retreat, avoiding the expense of acquiring and maintaining state licensure. Price Point “Lengthening the stay was quite critical to our plan for delivering strong outcomes, because the data show that stay length is a very key determinant in outcomes success,” says Houston. Backed by strong marketing, Houston’s approach has clearly struck a chord in the market, as there have been high levels capacity utilization at Mark Houston Recovery Centers almost from inception. And Houston earlier this year spent another $1 million to buy an adjacent ranch, almost doubling his capacity to 40 beds. In the post managed care environment, it has largely been the innovations and the risk taking of players like Mark Houston, treatment executives and clinicians turned entrepreneurs, that have led the resurgence of the treatment industry. Unique Entrepreneur But managed care intervened to interrupt this trend and, with their leveraged financial strategies exposed as imprudent when commercial payor dollars began to get cut off, Parkside, CompCare and the rest of the big roll up plays by the mid-1990s had all fallen by the wayside. This is not to say that, since then, the treatment market has been devoid of big, monied investors. Just the opposite. Emerging in the late 1990s were players like CRC Health Corp., which also employs a highly leveraged roll up strategy but takes a different operating approach that avoids cookie-cutter treatment and leaves acquired center storefronts intact. From early on, CRC was able to attract a range of well known institutional investors. And, after its 2005 acquisition of high-end leader Sierra Tucson, CRC engineered the biggest deal by far in treatment history, the $720 million sale of the company to private equity giant Bain Capital. In recent years, many other private equity firms have entered the business. And while these firms have financed some greenfield new center development, as well as expansions of existing facilities, private equity has mostly been piggy-backing off the efforts of individual entrepreneurs, acquiring their centers and providing a valuable source of exit finance. So, at least for the foreseeable future, it would seem that the treatment industry’s growth may continue to be driven by the efforts of smaller entrepreneurs. And a major impetus behind this entrepreneurial activity has often come from clinicians who were either dissatisfied with where they were working and wanted to implement visions of their own, or who were part of good programs that for one reason or another had been shut down. Sexual Healing And so both Deborah and Rip were surprised when the psychiatric facility was sold and the new owners made it clear that they no longer wished to house the program at the hospital. “There was a 14 acre property nearby in Argyle that was run down, but that we thought would be perfect to house a new center to continue our work. This year, Sante Center is celebrating its 10 year anniversary, but Corley says getting there wasn’t easy. “We are clinicians, not business people,” she said, adding that along the way,” says Deborah Corley, who, along with her brother, eventually acquired the property and opened. “We stubbed our toes plenty of times.” A key element in the early part of trying to get their center off the ground was getting the local bank on side. “We were lucky that the loan officer saw something in us and pushed through our little $150,000 SBA loan,” Corley says. Weathering such large setbacks as a major embezzelement by an employee, Sante Center has grown into a facility with 46 beds and a 100 client capacity IOP operation. This year the center will book about $8 million in revenue. “We opened our doors with three clients when eleven clients was break even,”says Corley. And in the last few years, like so many other treatment facilities, Corley says Sante Center has been running pretty much at capacity. TJ |

centers charge for 30-day inpatient, about $20,000.

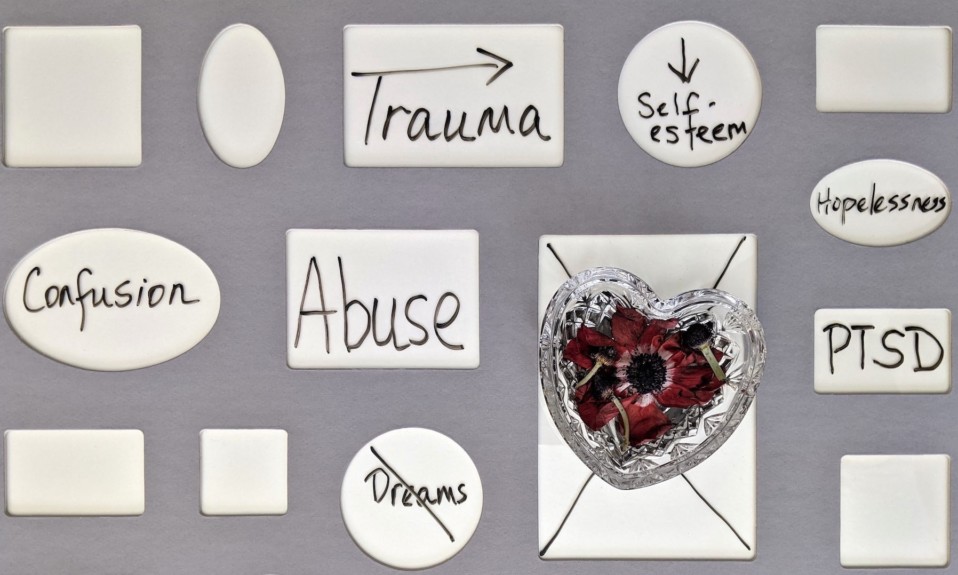

centers charge for 30-day inpatient, about $20,000. Working at a psychiatric hospital in Texas, Deborah and Rip Corley had labored hard to build a program for for addicts with problematic sexual behaviors. The program, which treated many who had been victims of sexual or other trauma, was quite successful.

Working at a psychiatric hospital in Texas, Deborah and Rip Corley had labored hard to build a program for for addicts with problematic sexual behaviors. The program, which treated many who had been victims of sexual or other trauma, was quite successful.