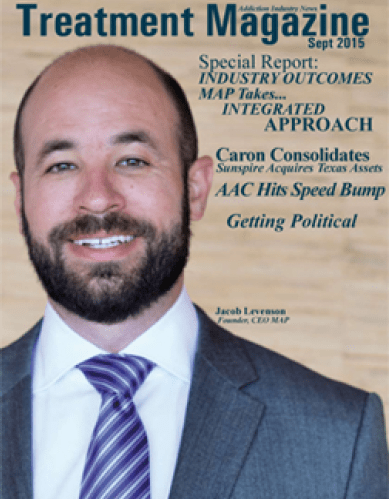

For Jacob Levenson, the story of how he got into the treatment industry is a pretty familiar one. He had, like so many others, an experience that had exposed him to the business and he saw opportunity as well as a chance to do some good. What Levenson did after surveying the treatment landscape was found a company in Austin, TX, that appealed to Levenson’s entrepreneurial zeal while at the same time identifying a major gap in treatment services that needed filling – outcomes measurement.

On the MAP

Since founding the company in 2011, Levenson has been able to put MAP Recovery Services on the map, so to speak, by being able to give everyone better information about what works, for whom, where and when among the 50 or so provider clients that so far form the universe from which MAP is culling its outcomes data, amounting, according to Levenson,, to some 1,200 inpatient and residential beds and 750 to 1,000 IOP slots. “The bottom line is that the payors don’t believe that treatment works so the providers are continually facing a deteriorating reimbursement environment that seems to be getting tougher by the day,” says Levenson, adding that the data that MAP is able to get into the hands of its provider clients can often give them an edge with the payors that can make a difference. The same is true for payors and the average consumer looking for where to get help for themselves or for a loved one. “We know within our network who is good at delivering care say, for example, for young adults or even older adults, so we can make the right recommendation, starting always with what’s best clinically and then factoring in things like financial constraints.” Levenson estimates that some $10M has been invested in systems and the like since MAP’s founding and it’s now time to really give growth a big push, even though the number of provider clients has roughly doubled over the last year, a pretty fast rate of growth.

Licensing the Model

But even at that growth rate, doubling the provider client base every year, Levenson knows that it will take forever for the company to grow and start to make a difference system wide unless a different approach is taken. This given the enormous fragmentation of the U.S. addictions marketplace, with more than 10,000 treatment centers on major nationwide lists like those provided online by SAMHSA, or the federal Substance Abuse and Mental Health Services Administration

Ramping Growth

Levenson says he knows that MAP itself will never take all the calls in-house and that he has to find a way to empower the clinician and therapist at the provider, or that may even be working for themselves in individual practice, and who needs the tools to cull through the enormous numbers of centers and choices. “In order to really help make effective use of the database and get growth on a trajectory where we really start making a difference, if we ever get to be that influential, we need to license the model.

New Revenue Paradigm

” By that, what Levenson means is that, ultimately, where he sees the company going in the next decade is that MAP will become somewhat like a franchise operation, where sales staff and clinicians at providers will have access to, and contribute to, the outcomes database as well as the model of intensive aftercare services in the form of 12-months of peer recovery support that will help drive tele-based and Internet-based aftercare, which is where Levenson sees huge revenue growth opportunities in what MAP ultimately identifies as a totally new payor reimbursement paradigm that is slowly, or perhaps quite quickly, emerging in the U.S. addictions marketplace. How MAP plans to participate in the new revenue paradigm it sees coming soon to a treatment center near you, as well as bring along its clients into the paradigm, is through the creation of the MAP Recovery Network. “We know change is coming, that much is clear with the complete removal almost all of the urine analysis as a source of profitability, which some centers were relying on almost completely to drive some form of bottom line so low have payor reimbursement rates gotten and so difficult has it become to collect any decent out-of-network benefits payments,” says Levenson.

The MAP Recovery Network

By now virtually everyone is familiar with the consolidation and mergers and acquisitions, M&A, boom going on in the front end of the addictions treatment marketplace – that is basically the very slow, and sometimes bumpy and uneven, amalgamation process whereby the highly fragmented 10,000+ center treatment market has been consolidating ever since the managed care debacle and the emergence of companies like CRC Health Corp several years later, which had M&A at the core of its growth model. But CRC soon found out it takes almost as long to close a small deal as a big one, with growth coming slowly because of the small size of average acquisitions. A special case blow up in the instance of the big Aspen Education deal effectively put CRC out of the M&A game except for the methadone clinic side and, ultimately help lead to CRC Health’s recent acquisition by Acadia Healthcare after an expert workout by former CRC CEO Andy Eckert.

MAP To Drive a Back-End Treatment Consolidation?

Because of the slow pace of front-end consolidation, MAP Recovery Network, which allows providers to maintain their front-end intact and may allow for more of a back-end consolidation of the treatment industry. The back-end consolidation facilitated by MAP is done mainly through the alliance created by the range of back-end services offered by MAP that can be private labeled and are based primarily on the quality differential that can be shown by the outcomes, which in turn are partly led by MAP’s strong 12-mo aftercare program. Utimately, it may be by products like the MAP Recovery Program, which offers a suite of back end services in addition to aftercare and the outcomes database, where the efficiencies associated with consolidation will be seen the fastest in the addiction treatment industry. MAP Recovery Network can be a way for centers to streamline costs and improve quality at the same time. If Levenson is right about a new, much lower, revenue paradigm, then programs like MAP may be the answer, with consumers, providers and payors all benefitting, which is what you get with an increase in productivty.TJ